A few years ago, Marc Galanter and Nick Robinson published a paper on the sprinkling of advocates that occupy the summit of the Indian legal world. They termed these members of law’s haut monde, whose exquisite silk gowns match the fabulous sums they command, as ‘grand advocates’. The paper was published in 2013, but it is hardly a revolutionary concept. The Bombay Bar has been nursery to these larger than life figures since the 1890s – the days of the fiery Anstey and the mild-tempered Inverarity. Knowledge of law is merely a necessary, and by no means sufficient condition to gain entry to these galactic levels. When they rise to address a judge, these advocates are expected to be able to hold forth on politics, drop literary references, and even engage in idle chitchat – surely one of the last remaining occupations where one is expected to be a generalist. Their pitch, tenor and language are meant to be spellbinding; evoking both the law of beauty and the beauty of the law. Their presence is supposed to win impossible cases. Some of this magic is imagined, but several regulars at the courts can testify to having seen the fortunes of a case change after the ‘senior’ is done arguing.

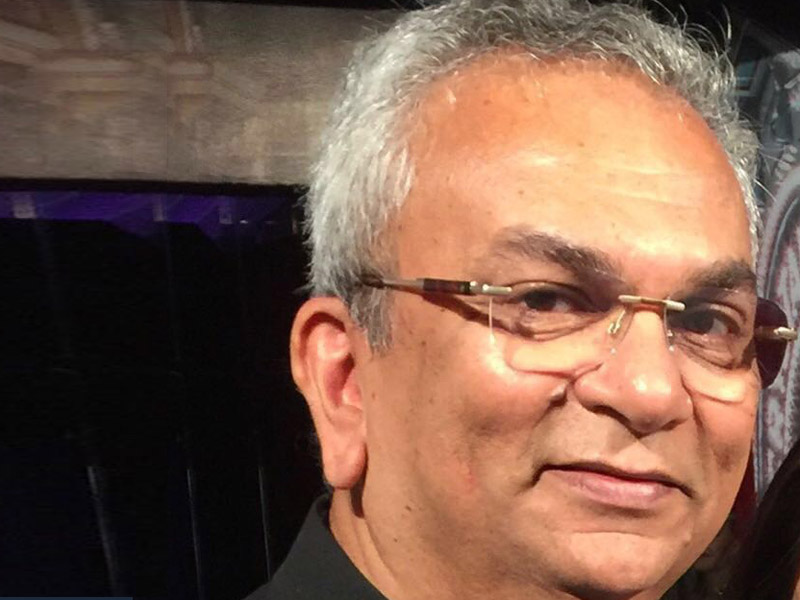

Ravi Kadam is one of the more prominent members of the current ‘Bombay set’. His services are solicited in various streams of the law, but he is not associated with any. His arguments in court give the impression that Galanter and Robinson had him in mind when they wrote about the grand advocates and “their strategic acumen, their preternatural articulateness…”

Lately, Kadam has been in the newspapers for appearing in many of the huge insolvencies being resolved under the Insolvency and Bankruptcy Code. Yet, when I sit down to interview him for this piece, he breaks the ice by engaging me in small talk about the criminal appeals he is currently arguing. The IBC cases are clearly only a speck of cloud in the view from where he sits. He tells me about his days as a struggling lawyer, working as an assistant government pleader while simultaneously trying to get noticed among the outsized talents that inhabited the chambers of the legendary JI Mehta. After a few humourous anecdotes about those days, the conversation tapers, and I switch the mic on. Without missing a beat, Kadam gives finely-nuanced, thoughtful answers to many complex insolvency-related questions that I have pondered for months on end.

We speak about the odious Section 29A, the correctness of the latest amendment on homebuyers, the structure of the Committee of Creditors and other issues.

It’s a ‘grand’ performance. Here it is:

TRANSCRIPT:

ADITYA BAPAT: With the passage of the Insolvency and Bankruptcy Code, we’ve seen a flood of litigation, especially as a result of the Reserve Bank of India’s decision to send India’s 12 biggest loan defaulters for insolvency resolution under its provisions. One of the senior counsel at the forefront of several of these big insolvencies is Ravi Kadam, and we have him with us. Thanks a lot for joining us today.

RAVI KADAM: You’re welcome..you’re welcome.

AB: So, to start off with, a general question. Prior to the Insolvency and Bankruptcy Code, we had a patchwork of laws governing insolvency: we had the Sick Industrial Companies Act, we had the RDDB Act, we had the Securitisation Act. So would you say that the Insolvency and Bankruptcy Code is an improvement on what preceded it?

RK: See I think it’s a much needed shock treatment for the big defaulters as well as those who are other defaulters, so they know what’s coming, and I think the government did an excellent thing by taking on first the largest defaulters, identifying them, and applying the law to them. So that no one can complain that the small people are getting hit and you’re letting the big men go. So this is an excellent idea both in conceptualisation…of course the law has taken time to evolve…and as we have worked it, we find so many problems, so those are being ironed out. But the idea of the IBC is an excellent idea. You know, Aditya, what was the position in the company court in the High Courts – company matters were stuck for years and years, nothing was happening. RDDB had its own limitations with the appeal from DRT to DRAT to writ petitions in the High Court to the Supreme Court – there also nothing was happening. SICA had clearly been, by the end of 2012-13, a failure, and there was therefore necessity to bring in shock treatment and this was a great move.

AB: Right. Now, when the Code began…it started off, and it still has in its provisions a strict 270 day timeline for the completion of the insolvency resolution process. You argued for the sanctity of that timeline when you argued Essar Steel on behalf of the creditors. But we’ve seen that both the NCLT and the NCLAT have relaxed this timeline to a certain extent because every time litigation comes they tend to stay the 270 day period. Do you think this has to a certain extent subverted the intent behind the insertion of this deadline or do you think it was unavoidable? Because the logic behind the insertion of the deadline was that with each passing day the enterprise value of the company reduces. So what do you think of the fact that tribunals often stay this timeline?

RK: See there is as you know, no power to extend the time. The original period is 180 days. It can be extended by 90 days, and beyond 270 days, nobody has the power to extend time. Courts being courts have innovated by providing for exclusion of time – not extension of time. Of exclusion of time taken in legal proceedings, exclusion of time taken in getting certified copies, etc. To the extent that these exclusion of time cases, or the cases in which the NCLT or NCLAT have excluded certain periods for counting 270 days…they have used it purposively for resolving insolvency. If an insolvency is almost resolved, and you’re running out of 270 days, on the end of 270 days the company would go into liquidation…So the NCLT and the NCLAT have innovated by providing for exclusion of time so as to achieve the object and purpose of the Act, i.e. insolvency resolution. So I don’t think that by stretching something…see, there’s a limit of 270, it can be stretched, but you can’t stretch it beyond breaking point. There is always a degree of elasticity in every legislation and that elasticity has to be there in the hands of those who are administering the law, that is the courts like the NCLT. So I am quite happy with that they’ve been doing it, and I don’t think that it defeats the purpose. In fact, on the contrary, it achieves the object of the Act. If you extend the time and get a plan through…a resolution plan.

AB: Because the alternative is liquidation.

RK: Exactly. That’s the bigger problem. So if courts take a rigid and a literal interpretation of 270 days, a resolution plan which has almost achieved finality will then fall by the wayside just because of the 270 days being over, so therefore sometimes if you exclude time, I don’t think they should go too far…but you exclude some time to achieve the object, then it’s a good thing, not a bad thing.

AB: A lot of the litigation that has surrounded the IBC has pertained to one provision: Section 29A. Now, for our listeners, Section 29A contains a laundry list of disqualifications for persons who are going to be submitting resolution plans…what have actually now become bids. Section 29A in its practical reality has disqualified promoters, who many would argue are the best to run a company since it’s their company, even in the absence of any evidence of malfeasance. It obviously shrinks the pool of eligible bidders and we’ve seen this increasing tendency of rival bidders using the section to get the other bidders disqualified. Do you think we need Section 29A or do you think it ought to be deleted?

RK: I think it ought to be deleted. You could at worst, or at best, have a provision where a wilful defaulter, identified and finally adjudicated to be a wilful defaulter, is kept out of the process. Many businesses have been run into the ground due to the wilful defaults of the promoters and such people can be kept out by a very specific provision. But an omnibus provision like 29A coupled with the further extension made in July 2018 to the ‘related party’ concept I think will defeat the object of achieving insolvency resolution for the simple reason that India, or our economy, is not deep enough to have such a large pool of bidders, and if you disqualify people on the basis of 29A, you are shrinking a small pool into an even smaller pool of bidders, and that doesn’t really achieve the object of getting back the money of the banks etc. So I think you are right, it’s also being used by one bidder against another so as to reduce the field, and in the process insolvency resolution and the recoveries that are being made by the CoC through the process are coming down. So this provision…the sooner it goes, the better. It’s a moral provision, really, and there is no place for that in an economic law.

AB: I think that’s a very thoughtful answer and I fully agree. Now, to push you a little further on these bids, we’ve come across instances where a losing bidder, after the bids have come in, is willing to bid a lot more than the winning bidder. In the Binani Cement case, in fact, the second highest bidder was willing to bid over 1000 crores more than the bidder that had come first. Now in the interest of value maximisation do you think a mechanism needs to be devised which allows for more than one round of bidding?

RK: This is a difficult question to answer because one understands that maximisation of value should be the primary object of any such process of selling off the assets or getting in new promoters to run an existing company. But at the same time there has to be a sanctity to the bidding process. So to reconcile these two things, one could have a more flexible bidding process as part of the statute or as part of the regulations in the CIRP process where you provide for some room or some elbow room or some flexibility, but in the existing circumstances if after the bidding is over someone comes in, then that might hurt the very sanctity of the bidding process, and if it happens in every case, then what is the point of having bidding at all? So it’s a difficult decision and I can empathise with the government in their dilemma as to how to handle this. They’ve left it to the courts at the moment, but frankly I think some regulatory steps by way of certain additional regulations for the bidding process, if put in place, would get rid of this problem, but how to solve it, I think the government is the best judge.

AB: Recently, the Insolvency and Bankruptcy Code was amended to include homebuyers as financial creditors. What do you think of this move?

RK: I don’t think it’s a correct move at all. Because homebuyers are certainly not financial creditors within the definition. The problem lies somewhere else and for every problem that arises you can’t keep on amending the Insolvency Code. Maybe some specific, special legislation for homebuyers, given the way they have been treated so badly by the home developers, is the correct answer. RERA may be made tighter; maybe you can have some overriding provisions there. But to bring into insolvency the homebuyer as a financial creditor…What is their muscle power? How do they stand in the committee of creditors? Who represents them? All these questions have been left unanswered by this homebuyers provision.

AB: Now I’m coming to a question, and its actually my final question – this goes to the core of the Insolvency and Bankruptcy Code. The fulcrum of the Act is the committee of creditors, which is expected to control the insolvency resolution process. Now, a committee of financial creditors controlling a company inverts the usual logic of corporate theory, which is that the company should be controlled by the equity shareholders because they are the owners of the residual value of the company, and therefore they have the highest incentive to maximise the profitability of a company…because they get paid last. Financial creditors actually get paid first. So they usually speaking only have the incentive to have their debts paid and move on. And therefore at least in theory they are less likely to worry about salvaging value for whoever is lower down the chain. Do you think the committee of creditors should be replaced with a committee that is more representative of all stakeholders?

RK: Yes, I think so. Particularly, I feel very strongly that operational creditors, many of them who have borrowed money themselves to supply goods and services to the corporate debtor, are put on a much lower scale in the scheme of things, and they do not even have a seat at the committee of creditors’ table unless they form 10% of the total debt. I don’t think that insolvency resolution can be so one-sided only in favour of one set of creditors, viz. financial creditors. So for operational creditors, it’s clearly a lacuna in the law, and the NCLTs and the NCLATs have been recognising this, and we find lately that in various cases, even after the resolution plan is otherwise in line with Section 30(2) the operational creditors are being paid something by the resolution applicants. Therefore a more representative CoC – how it should be structured is a difficult question – but certainly a more representative CoC will go a long way towards giving finality to the resolution process.

AB: Mr. Kadam, thanks a lot for a wonderful and engaging chat.

RK: Thank you.