The impact of the city of Mumbai on the Insolvency and Bankruptcy Code is abiding and all-pervasive: several of the members of the committee that drafted the law hail from the City, many giant Mumbai-based firms have found themselves having to tamely suffer the ignominy of being thrown into insolvency under its provisions, and industrialists like the Ruias and Ambanis, who could legitimately claim membership of the elite ‘Bombay Club’ of business moghuls, have had to polish their jugaad game to save their companies from its iron grasp.

In the manner in which pets resemble their owners (or spouses resemble each other), the Insolvency Code has even begun to resemble Mumbai – it was a brilliant idea to start with but is now complicated and unwieldy; if it had to be rebuilt from scratch, it would look nothing like it does today; it is permanently being repaired, without a thought for the people whose livelihood depends on it.

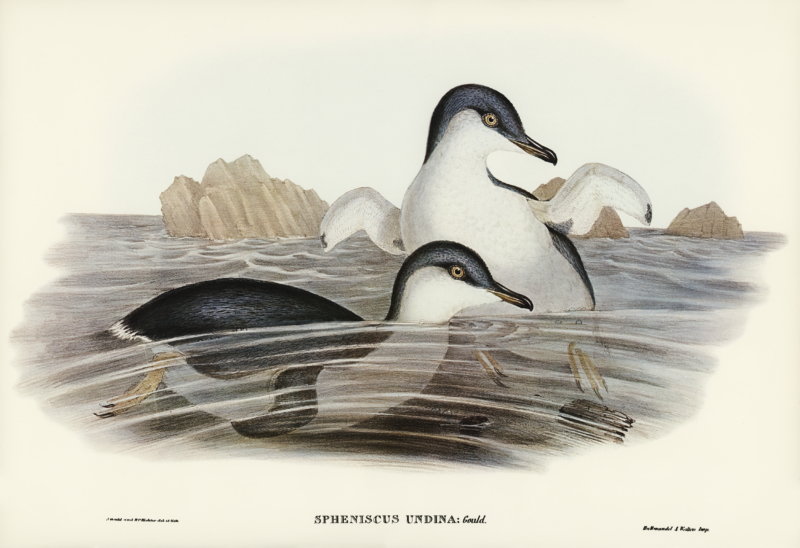

To continue in this vein, if the Insolvency Code evokes India’s capital of commerce, then Section 29A of the Code reminds one of the poor Humboldt penguins that were imported by the municipal corporation of Mumbai from South Korea to entertain citizens filing into Byculla Zoo, ignoring all warnings and protests. Like those penguins, Section 29A has become a headache for all concerned, it is leaking money, its continued presence is purely for face-saving purposes, and if the persons responsible for bringing it about had a chance, they wouldn’t.

Section 29A was brought in by an amendment, and was not part of the original Code. It disqualifies certain classes of persons from bidding for insolvent companies due to (a) their perceived role in the company defaulting on its loans or (b) because they are otherwise ‘undesirable’. I won’t go on about why I think Section 29A should never have been put into the Code, or why I think it betrays the vision of the Code’s draftsmen: you’ll find that here. Suffice to say that so vague are its provisions and so difficult is it to figure out who exactly it bars from submitting a bid, that in the ongoing battle for Essar Steel, both the top bidders, sophisticated companies with millions to spend on legal advice, went into the process thinking they were qualified, and ended up being disqualified.

The latest episode in the story of 29A comes in the form of the large-scale amendments to the Section suggested by the Ministry of Corporate Affairs’ Insolvency Law Committee in its report to the Finance Minister, which was made public on April 3.

Keep in mind that Section 29A consists of ten sub-sections (a to j) and one separate explanation (for the uncertain term “connected person”). Each sub-section details a category of persons that is disqualified from bidding under the Code. The report has recommended significant changes to the language of no less than six of these ten categories and to the explanation, almost all aimed towards diluting the range of persons covered by the Section. The Committee uses the picturesque term “carve-outs” to explain this, summoning the image of its members merrily wielding a scalpel on the sprawling tentacles of the Section.

The problem with the Committee’s antidote of yet more legislation is that more legislation is generally followed quickly by more litigation. Moreover, the fresh amendments do nothing to address the main problems with Section 29A:

- it debars persons who know the most about a company from having a role in its future;

- it fails to distinguish between insolvencies caused by crooked promoters and those caused by genuine business failures;

- it shrinks the pool of bidders, thereby reducing returns to stakeholders;

- the persons whom it disqualifies are otherwise qualified to own companies in India, so there is no reason why they cannot own companies that have come out of insolvency proceedings.

Sadly, too many important people are now invested in Section 29A for there to be a mea culpa and a total repeal. It will linger on, dripping lawsuits in its wake. Unlike its tuxedo-coated Antarctic cousin, which seems to be helplessly disappearing with the melting ice, this penguin is here to stay.